- 5 -

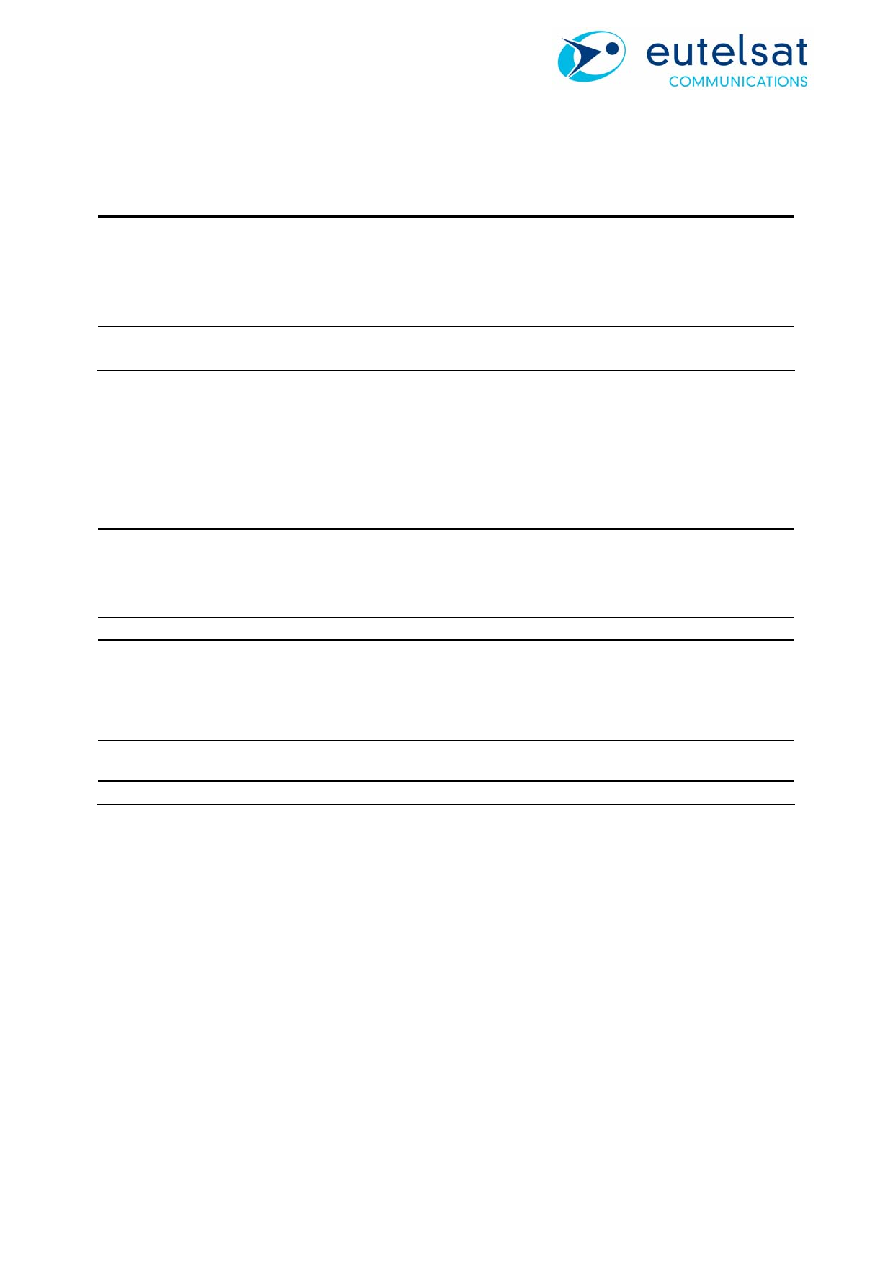

STRONG INCREASE IN CONSOLIDATED NET INCOME

Extract from the consolidated income statement

Six months ended December 31

In millions of euros

2005

2006

Operating income

132.9

179.5

Financial result

(118.0)

(56.5)

Income from equity investments

1.2

2.5

Income tax

(37.3)

(45.6)

Consolidated net income (loss)

(21.2)

79.9

Minority interests

4.5

4.9

Net income (loss), Group share

(25.6)

75.0

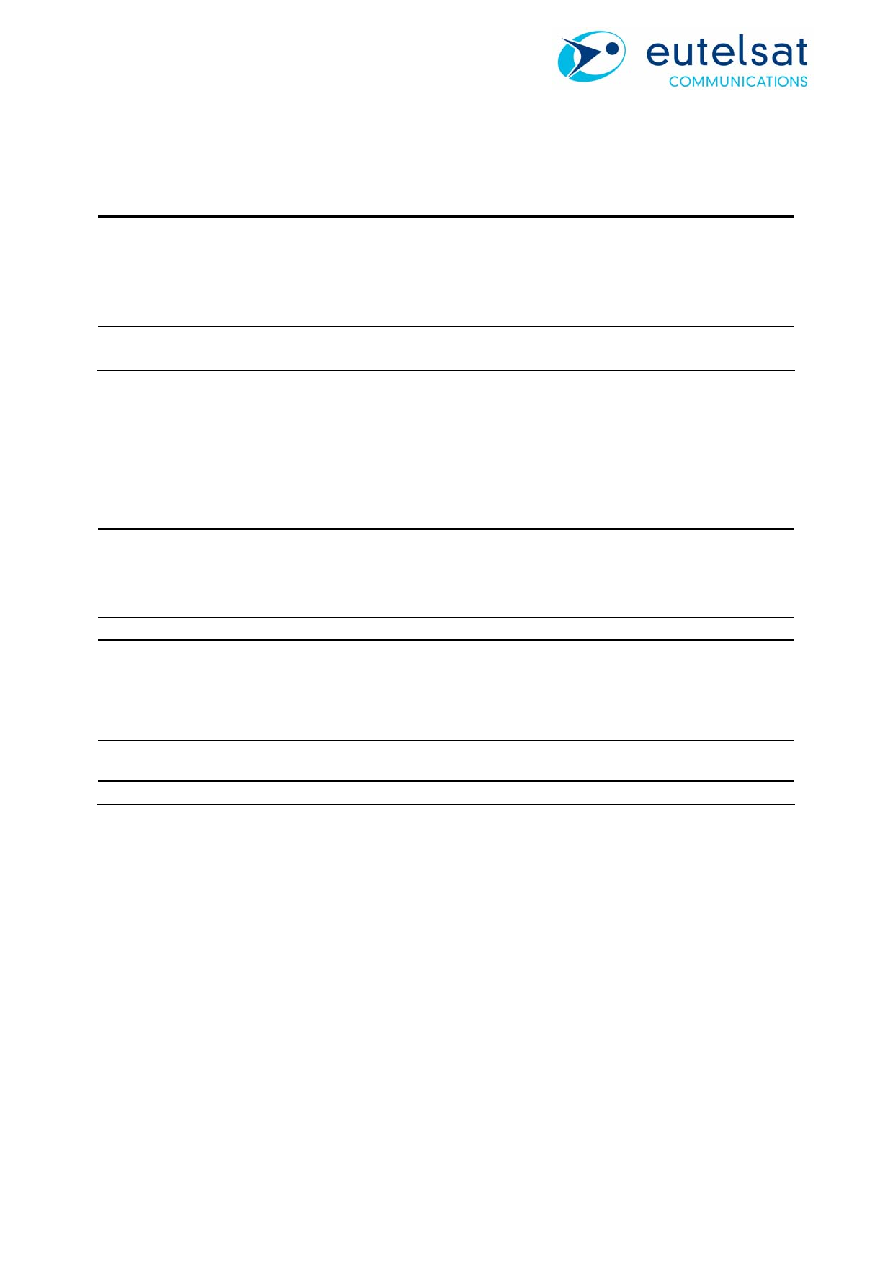

The improvement of financial result reflects the decrease and the refinancing of the debt which was

completed in the previous fiscal year. As a result, interest charges were reduced by 29.6 million euros

compared with the first half 2005-2006.

Financial result

Six months ended

In millions of euros

31/12/2005 30/06/2006 31/12/2006

Interest expenses & other

(84.4)

(53.7)

(54.8)

Hedging instruments

10.0

0.7

(0.2)

Foreign exchange gains / (losses)

0.2

0.3

(0.1)

Amortisation of loan set-up fees

(4.6)

(3.6)

(1.5)

Sub-Total (78.8)

(56.3)

(56.5)

Prepayment penalties and waiver fee (cash)

(14.2)

-

-

Write off of loan set up fees on PIK, Second

Lien and senior debt (non cash)

(25.0) (35.4)

-

Gain on hedging instruments subsequent to

senior debt refinancing (non cash)

- 30.1 -

Post-IPO debt restructuring costs and net

senior debt refinancing costs (sub-total)

(39.2) (5.3)

-

Financial result

(118.0) (61.6) (56.5)

Following these transactions and the simplification of the corporate structure, the effective tax rate

improved substantially to 37% for the first half 2006-2007.

Income from equity investments shows the contribution of Hispasat, the leading satellite operator in

Spanish and Portuguese-language markets, of which Eutelsat owns 27.7%.

Consolidated net income therefore increased strongly, driven by:

•

Improvement of operating performance leading to consolidated EBITDA growth of 6.0%;

•

Absence of the non-recurring items which had impacted financial results of the first half 2005-

2006;

•

Significant decrease in interest charges resulting from debt reduction and debt refinancing

completed during the previous fiscal year.